In early July 2024, the cryptocurrency market experienced a dramatic downturn, with leading cryptocurrencies like Bitcoin (BTC) leading the charge.

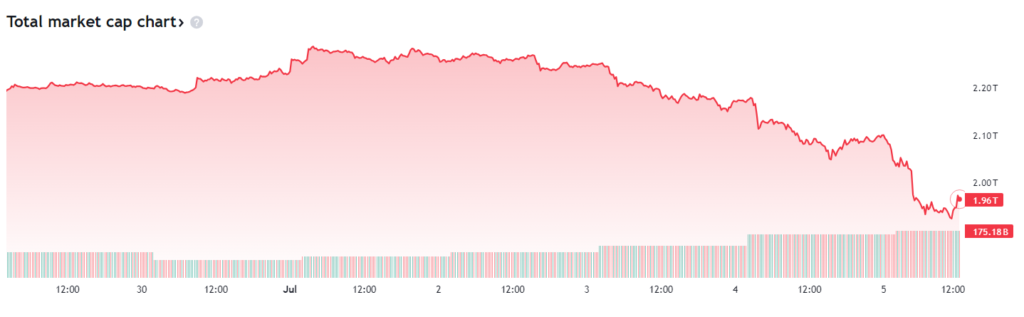

The beginning of the month saw two significant shocks: first, a staggering $130 billion vanished from the market’s capitalization in a single day. Just hours later, nearly the same amount was lost again within just 60 minutes.

This downturn pushed the overall market capitalization of cryptocurrencies below $2 trillion for the first time since late February. By July 5, the total valuation stood at $1.96 trillion.

It’s not just Bitcoin that’s been hit hard – the total crypto market cap excluding BTC also saw a significant drop. From $1.03 trillion on July 1, it fell to $880 billion by press time.

Could the crypto market bounce back to $2 trillion on July 5? Early trading on Thursday, July 5, hinted at a possible recovery. Though the market cap is still well below its yearly high and even its June levels, it has started to trend upwards after bottoming out at $1.93 trillion.

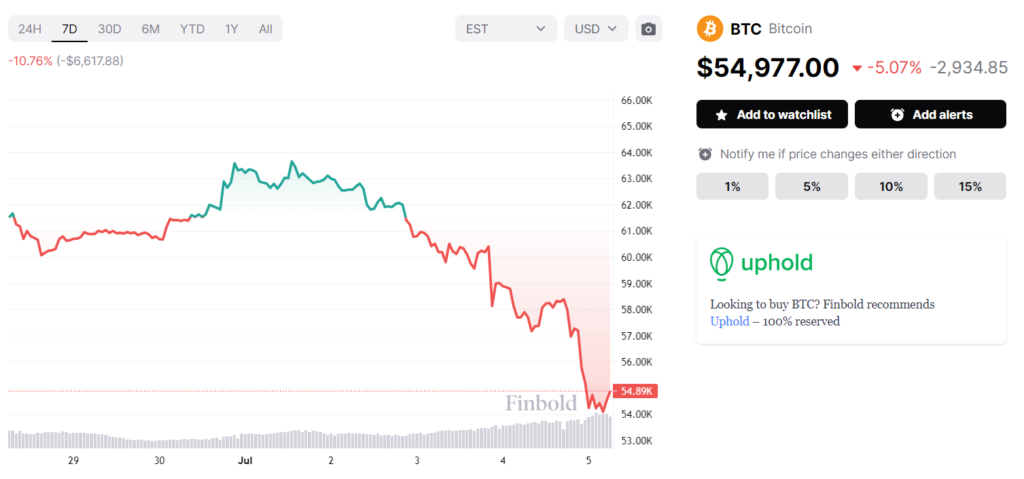

Looking at Bitcoin, it struggled to climb back to $55,000 early on Thursday morning after spending several hours below this price during the night. However, this upward trend doesn’t necessarily mean the decline is over.

In recent weeks, BTC has slipped from a stable level near $67,000, teasing possible recoveries at key support zones around $61,000, $60,000, and $57,000.

The coin’s future trajectory will likely depend on how investors perceive threats from Mt. Gox’s repayments and the German government’s Bitcoin sell-offs. The speed of the Mt. Gox repayments and whether creditors quickly sell their long-awaited BTC will also play a crucial role.

Interestingly, Peter Schiff, a noted critic, doesn’t think substantial selling pressure will come from Bitcoin ETF investors unless BTC drops below $38,000. Schiff shared on July 5 that most ETF investors aren’t losing money yet, but a price dip below $38,000 could trigger significant sell-offs, potentially leading to a catastrophic decline.